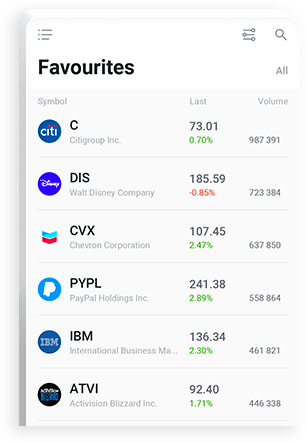

Depending on their traded volumes, liquidity, volatility, and spread values, stocks can be divided into three groups: blue chips, mid-caps and small-caps stocks.

Blue chips are commonly believed to be the most reliable and liquid. These are stocks of major global companies, such as Apple, Microsoft, Google, Coca-Cola, IBM, General Motors, etc. Mid-caps and small-caps stocks are less liquid but sometimes they can be more promising. Securities of famous companies do not always yield the highest profit, however, when it comes to investments, they are considered the least risky if compared with mid-caps and small-caps stocks. It might be a wise decision to create a portfolio that consists of stocks of different types.

More conservative traders prefer to trade stocks of American companies because the American stock market is thought to be more stable and liquid over the past decade. But certainly, if you want to try some "exotics", you can add some European or Japanese stocks to your portfolio. Investments in stocks of Chinese, etc. companies are riskier. These stocks may skyrocket of course, but there is a high risk of gaps in such markets.

Traders who are interested in trading stocks are divided into three categories:

- Passive (reliability and stability), who prefer "blue chips".

- Active (the highest possible profit with moderate risks), who mostly prefer "blue chips", but do not ignore mid-caps and small-caps stocks as well.

- Speculators (early income, short-term buying/selling), who choose the most liquid stocks, “blue chips”.

Being more reliable and liquid securities, “blue chips” may be considered ultimate instruments suitable for all traders who are interested in trading stocks regardless of their strategies. It’s important to understand that trading mid-caps and small-caps stocks requires traders to have advanced knowledge and impressive experience in trading on financial markets. Beginners are not recommended to add them to their portfolios, because injudicious actions may result in loss of some or all of your investments.